R&D Tax Incentive

How Can Start-ups Benefit from R&D

Research and Development Tax Incentive Australia

Does your business develop new products, new processes, systems or techniques? Do you develop new knowledge by making improvements to existing technologies? Do you need to carry out experiments through your development process?

The R&D process can be a challenging and risky one for businesses. The Federal Government provides some assistance through its R&D Tax Incentive, a program that provides Tax Offsets of up to 43.5% for companies carrying out Research and Development.

There are many areas to watch for!

Applications must be made within 10 months of the end of financial year

Eligible R&D activities

Maintain supporting documentation

Incur eligible costs

Provide evidence of payments made during the financial year

Expenses that can be claimed under the R&D Tax Incentive includes:

Salaries, on-costs and overheads;

Australian based consultants, contractors and other researchers;

Development of prototypes and production trials

Depreciation and lease of assets used in R&D

How to apply

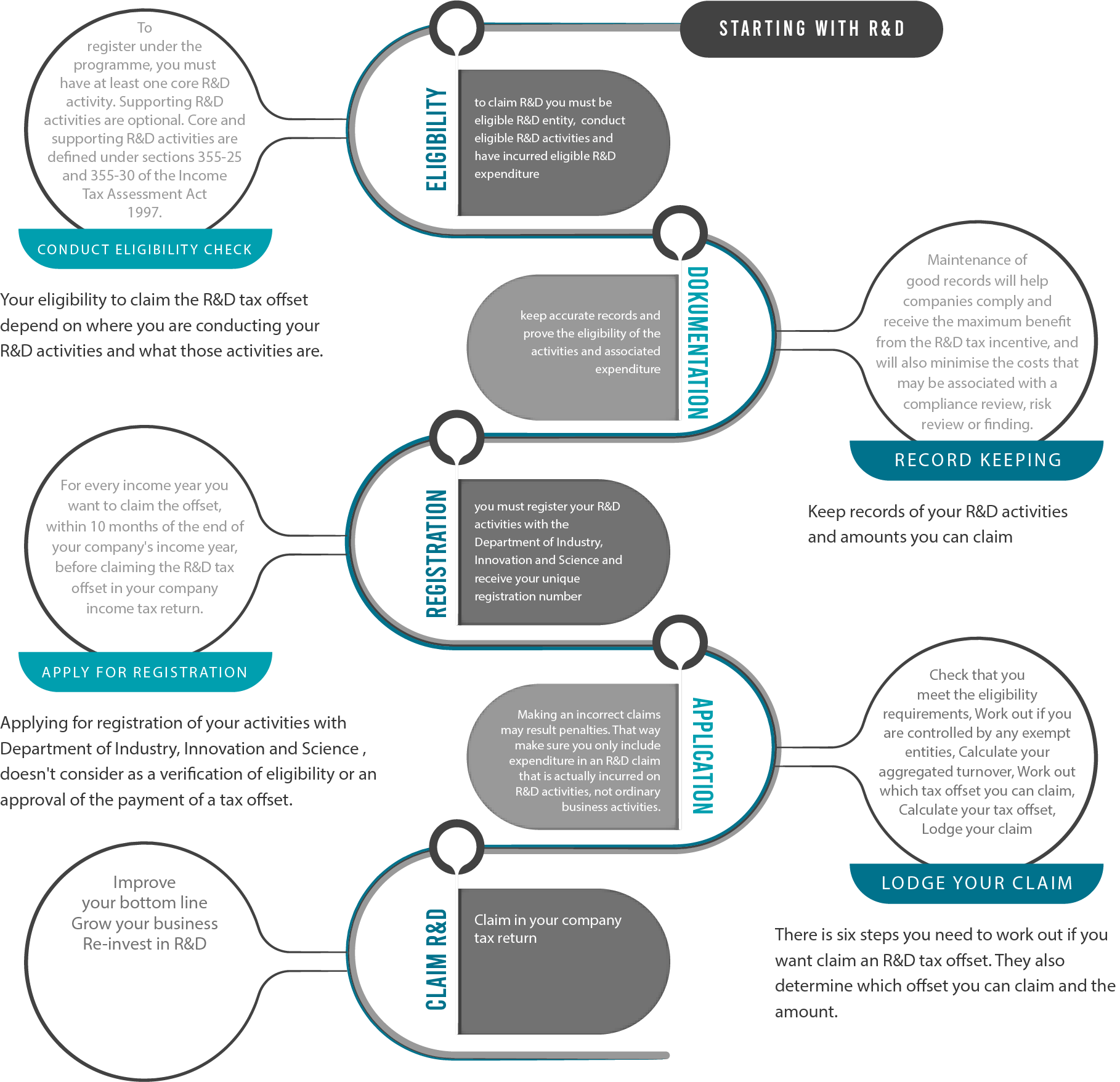

Applying for the R&D Tax Incentive can be a very involved process. You will need to undertake eligible R&D activities and maintain supporting documentation, incur eligible costs and provide evidence of payments made during the financial year.

Applications must be made with AusIndustry within 10 months of the end of the financial year. Companies wanting to apply for the Incentive need to first establish whether or not they are eligible. Generally speaking, any corporation that can prove their product/service is based on principles of established science and that it is conducted for the purpose of generating new knowledge may be eligible.

The Federal Budget generously allocates over $1.5 Billion on the Incentive and AusIndustry receives around twelve thousand applications a year from start-ups and established businesses.